Services

Many investors become fixated on portfolio returns. While returns matter, financial independence is more likely when adopting a holistic approach to managing your financial well-being.

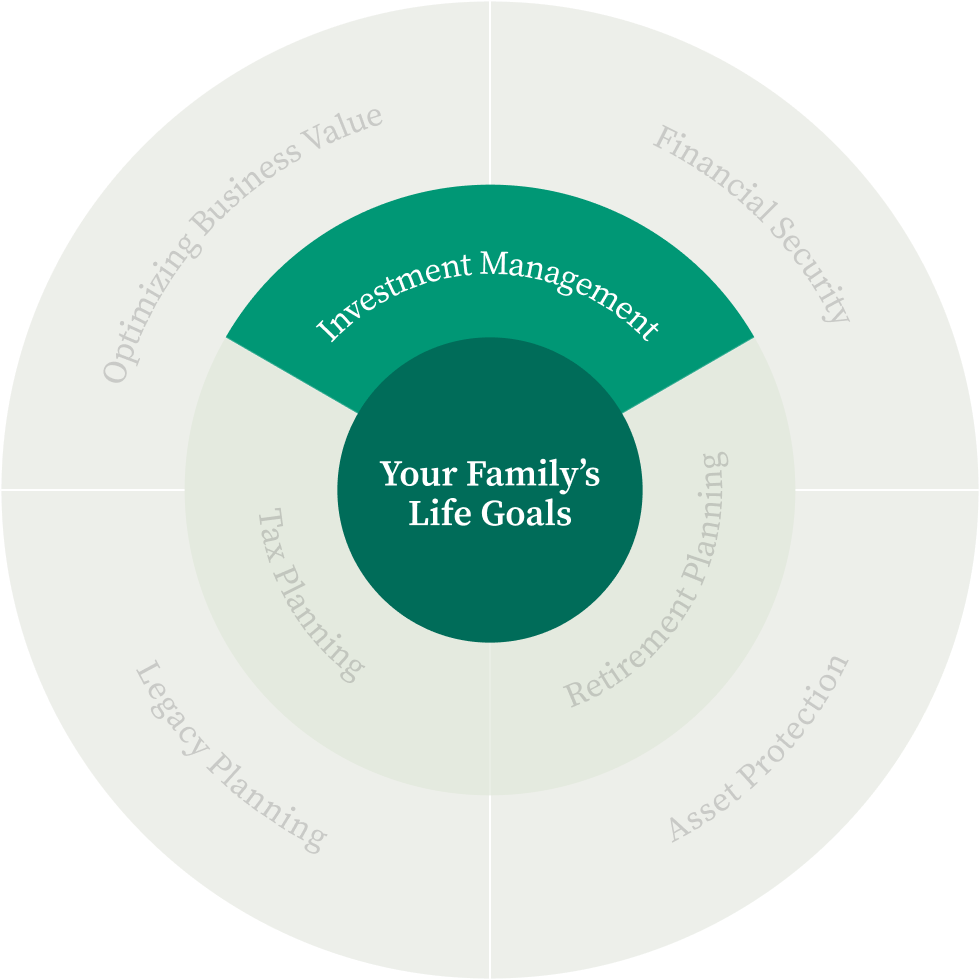

Management

The global geopolitical order is shifting in real time, and these tectonic shifts affect literally every part of economics and financial markets. Adapting rapidly to these massive changes is essential to preserving and growing portfolios.

We tap into the insights and forecasting models of numerous independent research sources, including Institutional Advisors, Schachter Energy Report, Martin Armstrong’s Socrates, and other regular guests of Michael Campbell’s Money Talks podcast and conferences. Portfolios are ideally positioned to help Clients successfully weather these unsettling times, and prosper as volatility creates major opportunities.

The Durability of Clients’ portfolios derives from two key factors: a strong structure (asset allocation) plus flexibility (active management). In broad terms, there are three components: stable income generation, stocks divided between dividend growers and momentum sectors, and opportunity seeking. Emphasizing high yield (income) reduces overall volatility in all market conditions, as well as generating sufficient cash flow for retired Clients.

Portfolios are all customized per family, custodied at a Canadian “Big 6” bank with Canadian Investor Protection Fund (CIPF) coverage. Our Portfolio Managers are all independent, employee owned, supervised/regulated directly by their local Securities Commission, and are led by experienced Chartered Financial Analysts (CFAs).

Planning

Perceptions of our “golden years” have changed dramatically in the last decade. The very term “retirement” suggests people are somehow “finished” or no longer useful. We could not disagree more.

We prefer to focus on “financial independence” and guide our clients through the technical aspects of planning for “life after work” including:

- Lifestyle & cash flow analysis

- Integration of public and private pension streams

- Investment strategies for income & growth

- Part-time work

- Taxable income splitting

We also explore the key ingredients to being happy, healthy and fulfilled when paid work no longer dominates our calendar.

Planning

Over the past five decades we’ve witnessed virtually uncontrolled over-spending by governments worldwide, and this has consequences. Looking forward, governments face rising interest payments on outstanding debt, a steadily shrinking workforce and rapidly increasing public healthcare costs.

These and other factors make widespread tax increases overwhelmingly probable. Income tax minimization before and after retirement, and after death, is more important than ever and an essential part of the Integrated Wealth Management process.

Based on each client’s unique circumstances we integrate various provisions of The Income Tax Act to significantly reduce clients’ household tax burden. Our portfolio managers help by allocating investments between registered and non-registered accounts as efficiently as possible.

Security

Our greatest financial resource is our health-based productivity. It enables us to earn employment and/or business income and live independently of paid caregivers.

It’s been said that, “life is what happens while we’re making plans,” so we should work and hope for the best AND protect against the worst outcomes: premature death, disability and elder care.

Insurance provides certainty and financial security for those affected by various life events, especially family. Appropriate life and health policies can help:

- Replace income

- Provide a lump sum for healthcare

- Help you age with dignity at home or in a care facility

Wherever necessary, we work closely with a 30-year insurance specialist with the highest level of professional ethics and knowledge.

Protection

Asset Protection refers broadly to shielding your hard-earned wealth from egregious taxation, litigation, public disclosure and marital breakdown.

Depending on individual circumstances, certain structures may be appropriate, including: Individual Pension Plans (IPPs), Estate Freezes, Family Trusts, highly-customized Permanent Insurance Policies, and even Offshore Entities. Where appropriate, we work with specialists to design and implement these.

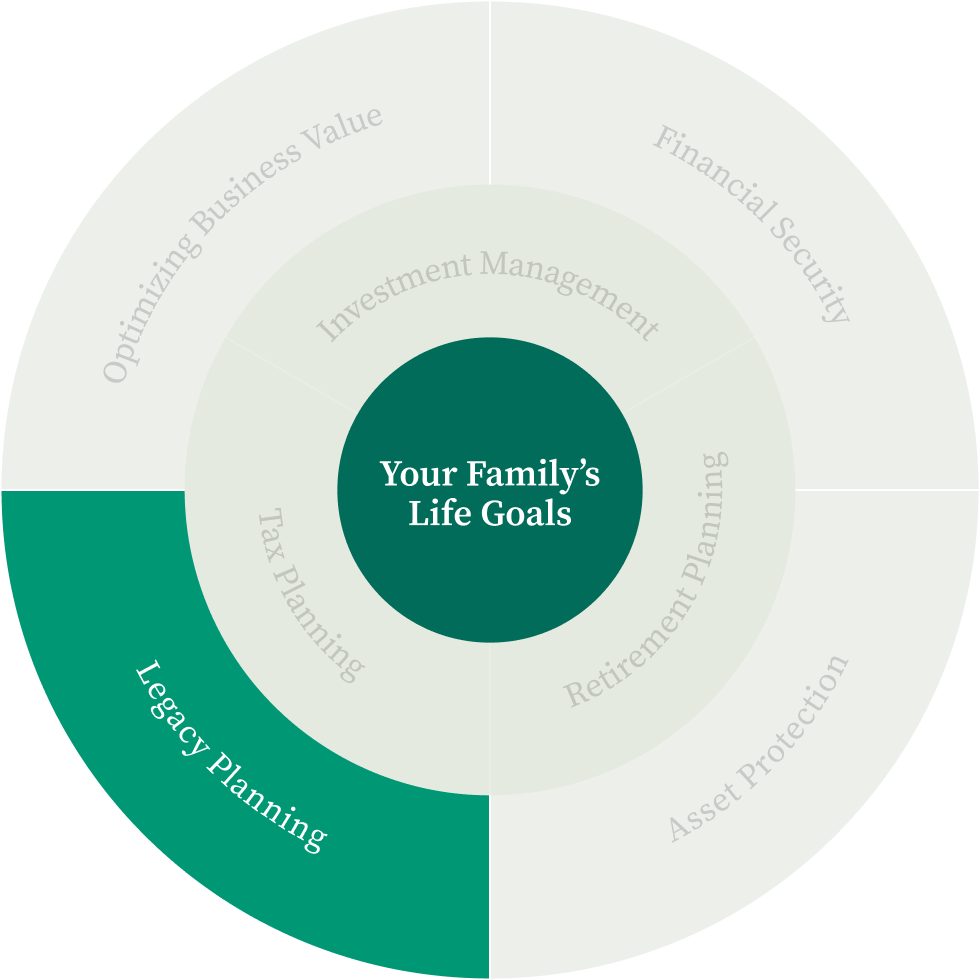

Planning

Legacy (or Estate) Planning is necessary at all ages, not just for seniors. The focus of Estate Planning is to preserve and transfer what you’ve built to those you care about either during your lifetime or after you’ve passed away.

Effective estate planning will minimize family conflict, eliminate unnecessary expenses and delays, reduce or eliminate income taxes and provide a smooth transition process for your appointed representatives.

Working collaboratively with experienced Estate Planning specialists, our team will help ensure you and your family implement the necessary legal documents, asset protection and tax planning structures.

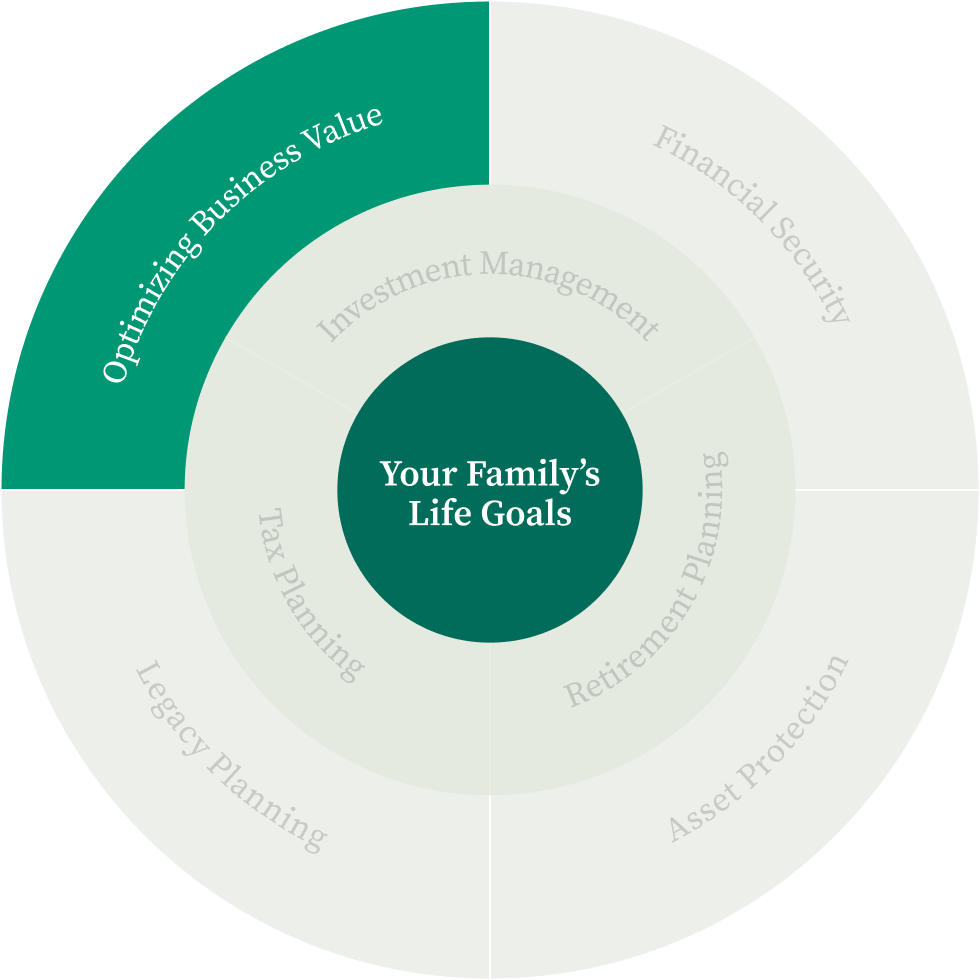

Business Value

If you own part or all of a private business, family farm or other incorporated entity, you understand risk and reward at a deep level. So, how do you optimize its value for you and possibly subsequent generations?

Estate Freezes, Family Trusts, Asset Sales, Share Sales, and Management Buyouts are some of the more popular options. Each has its merits, depending on your unique “fact pattern” and Life Goals.

Our team works with your trusted tax and legal specialists to find the optimal solution for your family. We can also introduce other professionals to complement – NOT replace – your existing team, and we’ll help coordinate their work within the scope of our mandate for your family.

We can meet in person or via Zoom. Let’s get to know each other to see if we be of service to help you achieve your financial goals.

learning.

Receive instant access to our comprehensive Library of investments strategies, market views, financial advice and more.

Are you prepared to

grow your portfolio?

Invest about 10 minutes and receive a custom report with a Readiness Score and ideas to improve how your portfolio is managed.

Start your assessment now: